The Finance Bill, 2017 passed as a Money Bill by Finance Minister of India, Arun Jaitley, has created quite a controversy in the country. As it was passed as a Money Bill, the Lok Sabha, led by the BJP, rejected the amendments suggested both by the Rajya Sabha and the Opposition. These amendments have been called “back-door” legislation by the Opposition, which takes away the role and right of Parliament in the framing of laws. The Finance Bills gives much more power to the IT department and has strict rules for tax defaulters. Read n to find out more:

The amendments have given more power to IT officials

Income tax officials can now raid people’s homes, and they do not have to give any reason for the raid. Only property which was “subject” of the raid could be seized, but according to the 2017 bill, any property of the person is liable to be seized (provisionally), during the course of a raid.

Income tax officials can also raid any property where charitable events are being conducted, and they can demand any information they require.

Aadhaar card has been made mandatory to file income tax returns

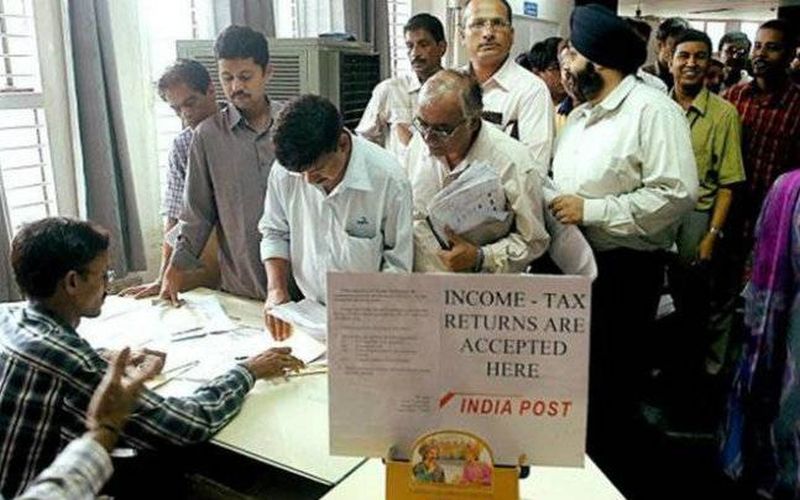

Image Source : ste.india.com

It is now compulsory to link Aadhaar card to PAN card, or your PAN card will be invalid after 1st July, 2017.

The upper limit of donations to political parties has been removed

With the help of ‘electoral bonds’, any one (person or company), in India or overseas can donate anonymously to political parties, any amount of their choice.

The Centre can choose tribunal members

With a gazette notification, the Centre can choose members of various tribunals, allowing the government to have unrestricted power over tribunals.

Tax rates have been changed

Image Source : media2.intoday.in

For the slab of Rs 2, 50,000 – Rs 5, 00,000, the tax has been reduced to 5% from 10%. For senior citizens, a surcharge at 10% has to be paid if income is between 50 – 100 lacs.

Reduction in rebate under section 87A

The maximum rebate for people whose income is less than Rs 3, 50,000 has been reduced to Rs 2,500 from the earlier Rs 5,000 for Rs 5, 00,000.

Revision of TDS if you pay Rs 50,000 rent a month

HUF/individuals now have to deduct TDS of 5% of the aggregate rent payable or paid in the financial year is more than Rs 1, 80,000. TDS provisions can apply only if HUF/individuals are subject to tax audit. TDS has to be deducted before March or the last month of the rent agreement (tenancy). TAN No is not required but if PAN is not furnished, then TDS will be deducted at 20%.

Joining NPS made more lucrative

If you join the NPS, (National Pension Scheme), you would be eligible for tax deduction under the provisions of section 80CCD, and withdrawal upto 25% is exempt as per NPS. If you are self-employed, then the contribution to the scheme has been increased to 20% (from 10%), of the gross total of your income.

Selling building or land

Image Source : media2.intoday.in

Presently, sale of building or land is considered to be long term if one or both are sold after 36 months. It is proposed to bring down the holding period to 24 months from 36 months.

No benefit of interest from second home borrowing

Currently, section 24 allows deduction upto Rs 2 lacs as interest on capital borrowed from self-occupied property, and one can claim any interest for deemed to be or let out properties. The Loss from HP can exceed more than Rs 2 lacs, due to this. The amendment to section 71 has restricted the loss to the amount of Rs 2 lacs.

No cash dealings

The cash transaction limit has been reduced to Rs 2 lacs from Rs 3 lacs, in a day.

Fees for delayed returns

You will now have to pay a fee if you delay in filing your income tax returns. Returns which would be filed after 31st December would attract a fine of Rs 10,000 and if income is less than Rs 5,00,000, there would be a fine of Rs 1000.

The Finance Bill lays stress on payment of taxes and digital mode of payment for more transparency. Time will tell whether the amendments would benefit the common man or not.