Companies always do reasonable research into prospect before acquiring another business, yet often they end up losing more than they paid. We take a look at the dumbest acquisitions ever made.

- Yahoo and Broadcast.com

Broadcast.com was an online television site that Yahoo acquired in 1999 for a whopping $5.7 billion. The company was way ahead of its time, but with a limited catalog, with only ‘60s monster movies and Victoria’s Secret fashion shows listed in its library. Coupled with the slow net connection of the time, Yahoo’s only way out was burying the business. If Broadcast.com would have survived the initial tirade, it may have been the Netflix of the 21st century. Sadly, Yahoo did not foresee these developments coming for a long time.

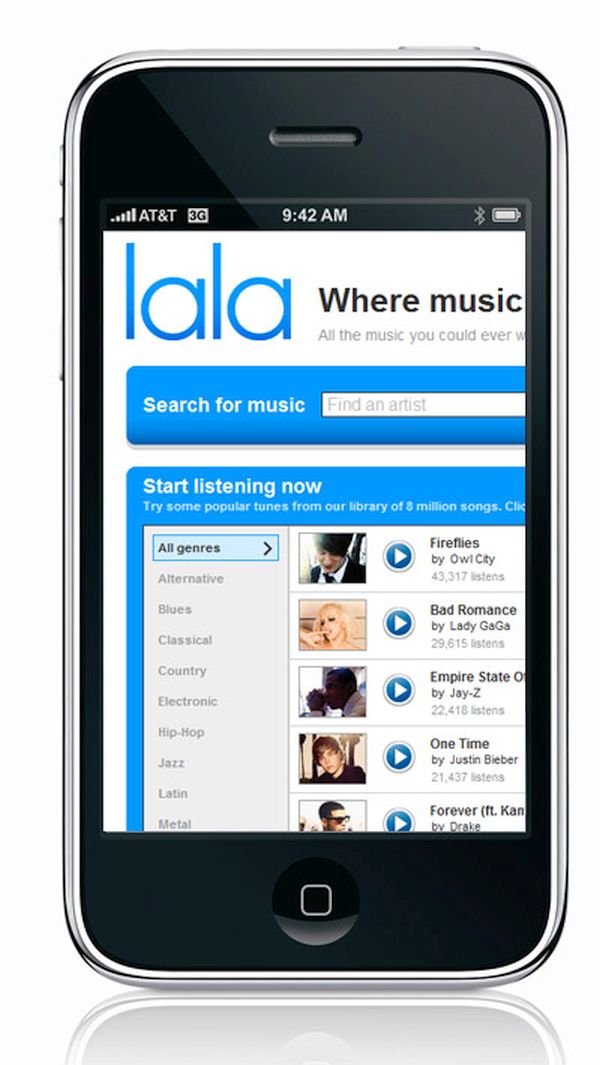

- Apple and Lala Music

Image Source : Techt20

Apple is associated with revolutionary business ideas but the Lala music acquisition will go down as a big failure. Bought for $80 million, Lala was offering some innovative pricing and services in music streaming. However, the rapid pace of innovation scared Apple and it decided to shut the business than take further risks.

- Microsoft and aQuantive

In a bid to compete with Google’s online ads service, Microsoft acquired aQuantive for $6billion along with $1.1billion worth debt. However, the company could not withstand competition and admitted that the business couldn’t boost sales as it had hoped. Yet another blow fell on Microsoft in its bid to compete with Google.

- Quaker Oats’ purchase of Snapple

Quaker acquired Snapple, a reputed drink for $1.7billiom with plans to merge it with its Gatorade operations business. However, they could not cash in and sold Snapple to Triarc for a mere $300million. Ironically, Snapple has since made a strong space in the market and is earning well. Smart marketing moves and fine tuning the strategy may have saved the Quaker a big loss and enhanced its prospects/

- Glaxo Wellcome/Smithkline Beecham

Image Source : Corporatewatch.Org

The merger of these two pharmaceutical giants in 2000 led the share market swooping as great potential was seen for obvious reasons. However, to everyone’s disbelief and at the cost of shareholder profit, GSK’s stock price plummeted from £21 to £15 in 14 years. This was a £30billion drop in shareholder wealth and a major blow to UK’s pharmaceutical industry.

Profit and loss is part of the game in business, however, one dumb move can shake shareholders’ confidence and jeopardize future business moves. Some deals were just not meant to be, while others were a collective failure of the management.