Did you know that your business can save anywhere between $2.87 and $3.15 per pay period if you switch to a paperless payroll system and electronic pay stubs?

With electronic banking and direct deposit on the rise, it only makes sense to use electronic pay stubs. Not only is it better and easier on your business, but it’s also better for employees too.

They can do all their banking on their smartphone and save valuable time.

This will make them better employees also since they’ll be less focused on mundane but necessary daily tasks and more focused on doing their work effectively and efficiently.

What’s on an Electronic Pay Stub?

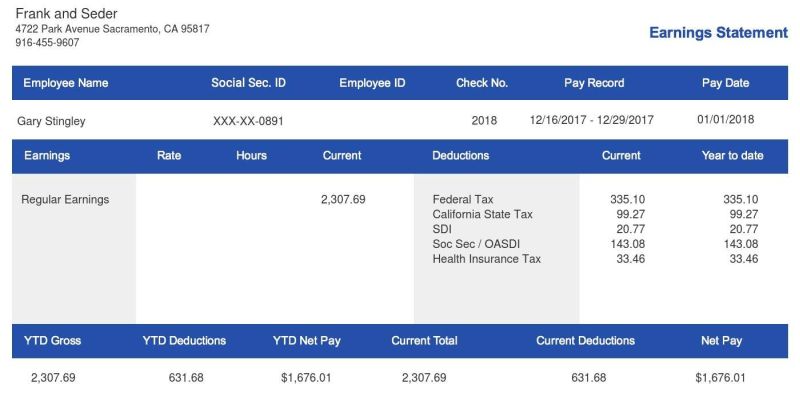

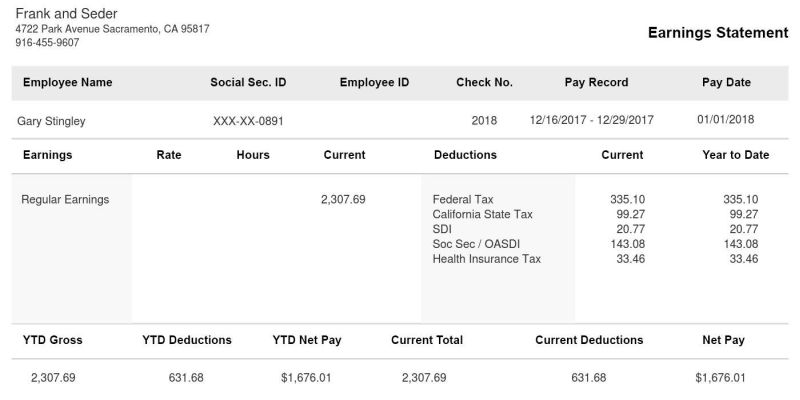

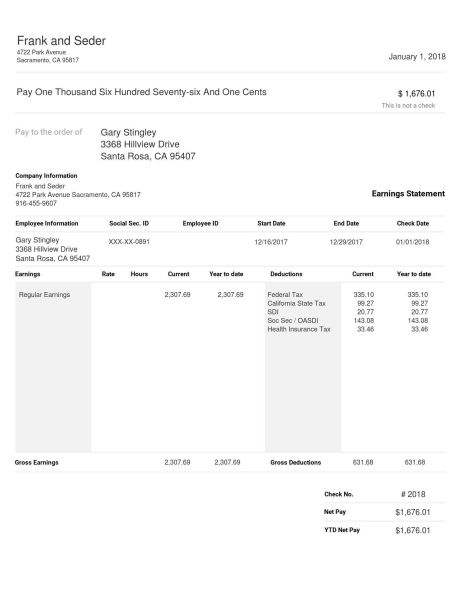

There are several things that you’ll find on an electronic pay stub. Most pay stubs have the same information, whether they’re paper or electronic.

There are several things that you’ll find on an electronic pay stub. Most pay stubs have the same information, whether they’re paper or electronic.

You’ll have that pay period’s salary and tax deductions. You’ll also have the year to date pay and tax information, both state and federal. If your employer provides you with health insurance, then you’ll have those deductions on there as well.

If you have a retirement plan through your employer, you’ll probably also see your employer’s contributions as well as yours for that pay period.

Plus, you’ll see your employer’s cumulative contribution and yours as well. And the current value of your retirement fund.

How Do They Make It?

There are a few different options companies have here. You can generate your own forms after entering the data manually. You can use an auto-fill form that can be connected to your bookkeeping software.

You can outsource your payroll department, and they’ll use their system. But, the best way to make it is to use a pay stubs generator.

How to Deliver It?

You can store every employee’s pay stub on your own secure server. Employees can access them by logging in to their own personal accounts. This will also help you monitor their sensitive information and keep a close watch out for cyber-criminals.

You can store every employee’s pay stub on your own secure server. Employees can access them by logging in to their own personal accounts. This will also help you monitor their sensitive information and keep a close watch out for cyber-criminals.

If you have an in-house email client, you can send them through a secure or password-protected email message.

However, many employees prefer the cloud-based or personal server-based system. That’s because they drop the ball on keeping their email credentials secure.

Electronic Pay Stub Requirements

Each state has different requirements and reporting needs for their pay stubs. Electronic pay stubs in California need to have 10 items to be legal and within state laws.

These ten times are accrued paid sick leave, gross wages earned, total hours worked, and all deductions from wages. They also need to have the number of piece-rate units that were earned if applicable.

As well as net wages earned and pay period starting and ending dates. They also need to have the employees’ name and the last four of their social security number or Tax Id number.

Lastly, they need all hours worked and how much per hour the employee made, and the employer’s complete address.

Electronic Pay Stubs

Now you know what an electronic pay stub is, how it works, and why you’d want to use them. If you liked this post, check out our Tips & Tricks session for more awesome info.

Now you know what an electronic pay stub is, how it works, and why you’d want to use them. If you liked this post, check out our Tips & Tricks session for more awesome info.

Article Submitted By Community Writer