Indian economy is going great and this is the best time for investors, domestic and foreigners both who are looking for long-term returns, to invest in the Indian market. India has showed the ability to have sustained economic growth in almost all sectors.

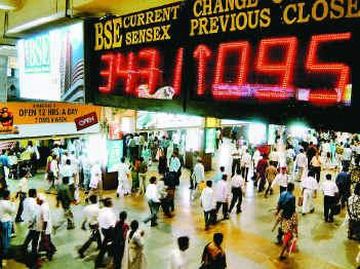

Sunil Singhania, fund manager of Reliance Mutual Fund, said he believed that the market capitalization of the BSE would go double by 2010. Reliance Mutual Fund house handles more than $17 billion in assets.

Sunil Singhania said that the Bombay Stock Exchange (BSE) might see the capitalization rise from $1.2 trillion just because of India’s strong economic growth. Indians have developed great confidence in capital market investments. The rise in market capitalization is not the short-term development.

The new trend has been developed among Indian investors to take any kind of selling by foreigners as a big buying opportunity. He said that if the foreign investors sold their shares in India, Reliance mutual fund house were among the active buyers in the market.

Singhania said that the prospect of healthy domestic growth is the result of massive growth in service sector. Service sector accounts for a major part of country’s income and it helps in attracting foreign investment in Indian market. The higher industrial productivity, a youthful professionals and an influx of foreign funds have also contributed in country’s economic growth.

He said further that the booming economy has placed the BSE among the largest bourses in the world. More than 4,850 companies have been listed in the BSE till date and the market is still offering great depth with potential to investors. However, he also expressed concerns on India’s trade deficit because of the high oil import bills. India imports more than 90% of its oil consumption.