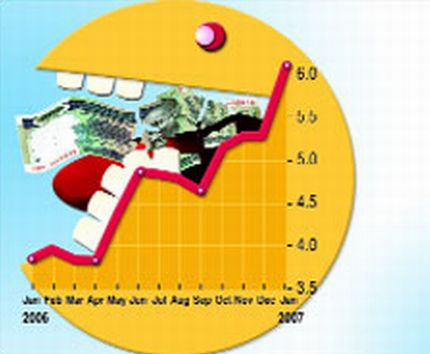

The Inflation on the Wholesale Price Index (WPI) has gone up to a 2-year high at 6.12% in the current week that ended on January 6. According to RBI norms, the 5-5.5% inflation rate is acceptable but it has been crossed the acceptance level.

The prices have seen a sharp rise of primary products by 9.3% compared to prices in the corresponding week last year. However, the fuel prices have risen merely 3.6% year-on-year.

If we see in the complete economic term, the oil prices are based on various global factors and as far as commodity prices is concerned prices of primary articles get affected by short term factors.

They are often highly unstable and many countries look at core inflation. The Core inflation means excluding the prices of these two highly volatile components from the inflation figures.

And even if happens the inflation based on prices of manufactured goods, a measure of core inflation, rose by 5.9%.

The Finance Minister P. Chidambaram has also expressed his concern on inflation rate. He said

this is a matter of concern and the Government is seriously thinking to take some steps to control the inflation rate.

He said that the Ministry of Finance is in touch with the Reserve Bank of India and Agriculture Ministry, and we will do whatever is needed.

Former RBI Governor and chief economic advisor to the Prime Minister C Rangarajan has been also expressed his concern over the rising inflation rate. He said that

the trend was in the direction of inflation accelerating. If inflation rises beyond 5.5%, it is a matter of concern and can cause problems in the exchange rate.

The analysts are saying that the Indian economy is overheating with its high growth rate and rising inflation rate, high real-estate prices and rising salaries.

However, the RBI has taken a number of steps to tighten monetary policy and to stop the further inflation rate. RBI has raised the Interest rates such as the repo rate and the reverse repo rate in recent months and the Cash Reserve Ratio has been hiked.

And now the analysts saying that the combination of a rising rupee and small rises in interest rates could effectively curb inflation in the coming few months.

Read